Boat Drops: Your Portal to Aquatic Adventures

Explore the world of boating with tips, news, and insights.

Instant Crypto Transactions: Fast Cash or Digital Mirage?

Discover if instant crypto transactions are the key to fast cash or just a digital illusion. Dive into the truth now!

Understanding Instant Crypto Transactions: How They Work

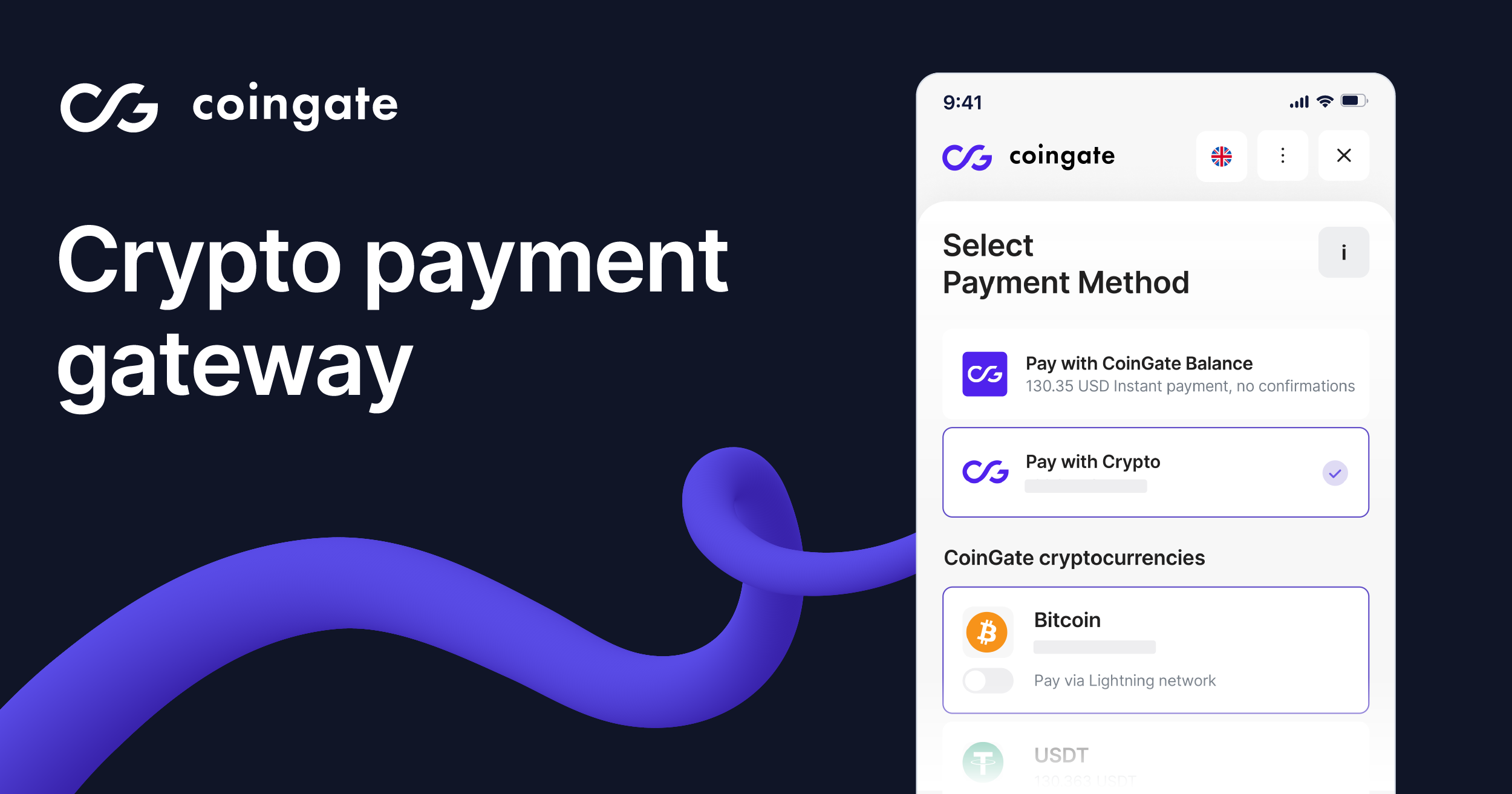

Instant crypto transactions have revolutionized the way we think about financial exchanges in the digital age. Unlike traditional banking systems that can take days to process transactions, instant crypto transactions are designed to offer quick, seamless transfers of cryptocurrency. This efficiency is primarily achieved through blockchain technology, which allows for the direct transfer of assets without the need for intermediaries. By utilizing a series of complex algorithms and consensus mechanisms, cryptocurrencies like Bitcoin or Ethereum validate transactions within seconds, making it possible for users to send and receive funds anytime and anywhere.

Moreover, many blockchain networks are now integrating Layer 2 solutions, which enhance transaction speed and reduce congestion on the main blockchain. These solutions work by processing transactions off the main chain before settling them in bulk, which significantly decreases the time and cost involved. This innovation not only allows for instantaneous transactions but also improves the overall user experience, making cryptocurrency a more viable option for everyday transactions.

Counter-Strike is a popular team-based first-person shooter that has captivated gamers since its release. Players assume the roles of terrorists or counter-terrorists, engaging in various objective-based game modes. With its competitive scene and strategic gameplay, it remains a favorite among esports enthusiasts. For players looking for exciting bonuses, check out the bc.game promo code to enhance your gaming experience!

Are Instant Crypto Transactions the Future of Banking?

The landscape of banking is undergoing a significant transformation, and instant crypto transactions are at the forefront of this change. Traditionally, banks have facilitated transactions that can take hours or even days to complete, but with the advent of blockchain technology, the potential for immediate fund transfers has become a reality. This shift not only enhances the speed and efficiency of transactions but also reduces the costs associated with cross-border payments and remittances. As more people become aware of the benefits of instant crypto transactions, it's likely that we will see an increased demand for these services, prompting traditional banks to adapt.

Moreover, the rise of instant crypto transactions presents a unique opportunity for financial inclusion. Many individuals in underserved regions lack access to traditional banking services, yet they possess smartphones and an internet connection. By leveraging cryptocurrency, these individuals can engage in instant transactions, enabling them to participate fully in the global economy. As such, the future of banking may very well hinge on how effectively financial institutions can integrate instant crypto transactions into their existing frameworks while ensuring security and compliance with regulatory standards. The question remains: can traditional banks keep pace with this digital evolution?

The Pros and Cons of Fast Cash: Is It Worth It?

Fast cash loans can be a tempting solution for those facing unexpected financial emergencies. One of the primary advantages is the speed with which you can obtain funds—often within hours of applying. This rapid turnaround can provide much-needed relief in situations where immediate cash flow is critical, such as during medical emergencies or urgent home repairs. Additionally, many lenders have flexible criteria, making it easier for individuals with less-than-perfect credit to qualify for a loan.

However, fast cash loans also come with significant drawbacks that potential borrowers should consider. One major con is the high interest rates typically associated with these loans, which can lead to a cycle of debt if not managed properly. Furthermore, the easy accessibility of these funds may encourage impulsive spending rather than careful financial planning. Thus, while fast cash can offer a quick fix, it’s essential to weigh the long-term financial implications before diving in.